The market for healthcare properties has been resilient during tough economic times. The prices of medical properties will continue to rise because of the increasing demand for medical services.

It is, therefore, attractive to investors to invest in medical real estate. They can invest in medical assets to diversify their investment portfolio.

Also read: The Future of Medical Real Estate in Australia

Here are 3 key reasons to invest in medical real estate:

1. Stability

- Medical real estate is attractive to many investors since the healthcare sector is recession-proof. The fluctuations in the economy cannot impact the medical field. Investors can retain their tenants during tough economic times.

- There will always be a demand for healthcare professionals in the world. The demand for healthcare properties will persist. The tenants can even sign long-term leases.

- Signing long-term leases can mean stability for the landlord. A long-term lease guarantees ongoing tenancy and offers the stability of income.

2. Profitability

- Investors can earn reliable income in medical real estate. Targeting medical tenants can mean reliable income.

- The value of the healthcare properties can also increase over time because of the increasing demand for healthcare.

- According to a study in Statista, about 10 percent of Australia’s GDP goes on preventive care services even before the pandemic came. This value amounted to 195 billion Australian dollars for the financial year 2019.

- The 2019 General Practitioner Workforce Report by Deloitte also revealed that there will be a shortfall of nearly 9,300 full-time general practitioners by 2030. Supply and Demand 101. Medical real estate has never been more vibrant.

3. Maintain Longer Tenancies

- Healthcare professionals use specific equipment. It is, therefore, expensive to fit out their space with their required equipment. Most of these healthcare professionals will remain in the same place because of this cost.

- Once the healthcare professionals fit out their offices, it is expensive for them to leave. Most of them will prefer to stay in the same office for longer.

- Investors are more likely to build long-term relationships with their tenants.

Once you decide to diversify your investment portfolio, you might want to consider investing in medical real estate. It is profitable to invest in medical real estate because of the increasing demand for medical services.

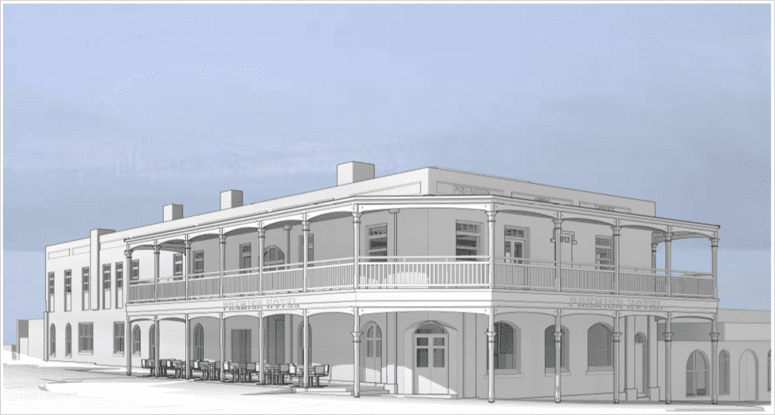

If you are looking to invest in medical real estate in Albany, Western Australia, feel free to contact Realforce Property today.

Related Posts: